add capitaltech REVENUE-SHARING tokens to your INVESTMENT portfolio

We use blockchain to tokenize projects and generate smart contracts for transactions.

Accredited investors only

Future Growth Potential as explained by Onyx Digital assets

Thanks to “DeFi,” or decentralized finance, anyone with an interest and a Keyboard can take part in this revolution and benefit from the billions in value that this infrastructure will generate over the coming decades.

The CapitalTech Fund is Offering Revenue Share Tokens (RSTs). Assets That Are Tokenized And Posted On A Blockchain. These RSTs Provide Investors With Several Key Benefits That Traditional Investments May Not Offer: Including Transparency, Liquidity, And Security. By Leveraging Blockchain Technology, CapitalTech Is At The Forefront Of A New Era In Investing, Offering Innovative Solutions That Cater To The Evolving Needs Of Modern Investors, LP.

-

- Revenue Sharing Agreements (RSAs): CapitalTech can provide financing through RSAs, where your company agrees to share a percentage of its future revenue with CapitalTech in exchange for upfront funding. This can be particularly beneficial for companies with steady revenue streams looking to expand or cover operational costs without taking on traditional debt. Tokenization on the Blockchain: CapitalTech has expertise in tokenizing assets, including revenue-sharing agreements, on the blockchain. This can make your company’s investment opportunities more accessible to a broader range of investors, as tokens can be bought, sold, and traded more easily than traditional securities.

CapitalTech is becoming a leading provider of Revenue Sharing Agreements (RSAs) by leveraging its expertise in finance, technology, and innovative business strategies. Here’s a description of key steps and strategies:

-

Specialization and Expertise: CapitalTech can establish itself as a specialist in structuring, negotiating, and managing RSAs. This entails developing a deep understanding of various industries and businesses to tailor RSAs that meet their specific needs.

-

Innovative Products: CapitalTech can differentiate itself by offering innovative RSA products that cater to different types of businesses and investors. This can include customizable terms, flexible payment structures, and integration with blockchain technology for transparency and liquidity.

-

Strategic Partnerships: Collaborating with investment banks, finance companies, and other financial institutions can enhance CapitalTech’s reach and credibility. These partnerships can provide access to a wider pool of investors and businesses seeking RSAs.

-

Technology Integration: Leveraging technology, such as blockchain and AI, can streamline the process of issuing, managing, and trading RSAs. This can improve efficiency, transparency, and security for both CapitalTech and its clients.

-

Educational Resources: Providing educational resources and training programs on RSAs can help demystify this financial instrument for potential investors and businesses. This can build trust and credibility for CapitalTech as a leading authority in RSAs.

-

Customer Service: Offering exceptional customer service and support can set CapitalTech apart from its competitors. This includes personalized assistance throughout the RSA process and responsive communication to address client needs and concerns.

-

Regulatory Compliance: Ensuring strict adherence to regulatory requirements and industry standards is crucial for building trust and credibility in the market. CapitalTech should stay updated with changes in regulations related to RSAs to maintain compliance.

-

Bridge Loans for financing pre-syndication expenses:

- Overall, CapitalTech can tailor its financing solutions to meet your company’s specific needs, whether you’re looking for short-term funding to cover operational expenses or long-term capital to fuel growth and expansion.

Successful investing depends on thorough analysis, not whimsical prediction. CapitalTech believes good results in investing are the product of good thinking. The firm’s goal is to apply disciplined bottom-up analytical procedures, sophisticated legal and financial structures, and proactive asset management to transactions that possess a value-oriented investment thesis.

What is A CapitalTech Revenue Share Token?

A CapitalTech Revenue Share Token is a digital asset issued on a blockchain that represents a share of the revenue generated from a specific project or investment opportunity facilitated by CapitalTech. When an investor purchases these tokens, they essentially acquire a portion of the future revenue generated by the underlying project.

Here’s how it typically works:

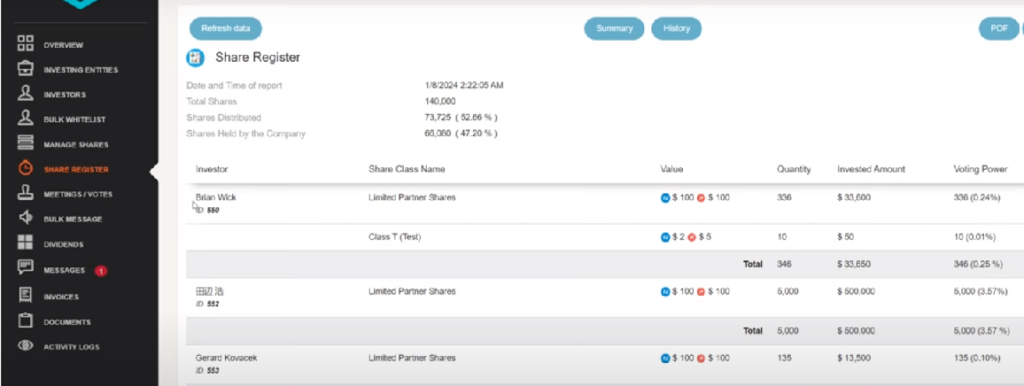

- Issuance: CapitalTech issues Revenue Share Tokens as digital tokens on a blockchain using smart contracts to automate the distribution of revenue shares.

- Investment: Investors can purchase these tokens using cryptocurrency or fiat currency.

- Revenue Sharing: As the underlying project generates revenue, a portion of that revenue is allocated to the holders of the Revenue Share Tokens. The percentage of revenue allocated to token holders is predefined and outlined in the terms of the token issuance.

- Distribution: The revenue is distributed to token holders automatically through the smart contract. This process ensures transparency and eliminates the need for manual distribution.

- Trading: Since these tokens are digital assets they can be traded on compatible exchanges and platforms that support the specific blockchain on which they are issued. This provides liquidity to investors who wish to buy or sell their tokens.

- Redemption: Depending on the terms of the token issuance, there may be a mechanism for redemption where investors can exchange their tokens for a predetermined value or a share of the project’s assets.